new mexico solar tax credit 2020 form

For each solar market development tax credit approved by the New. The New Mexico Solar Market Development Tax Credit or New Mexico Solar Tax Credit was passed by the 2020 New Mexico Legislature and signed by New Mexico Governor Michelle.

A Guide To New Mexico S Tax System New Mexico Voices For Children

This incentive can reduce your state tax payments by up to 6000 or 10 off your.

. This bill provides a 10 tax credit with a savings value up to 6000 for a solar energy systems. With the typical system in New Mexico totaling 18760 the federal tax credit averages around 5628. The New Solar Market Development Income Tax Credit was passed by the 2020 New Mexico Legislature.

It provides a 10 tax credit with a value up to 6000 for a solar system. This amount is credited to your federal income taxes due for the year. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers.

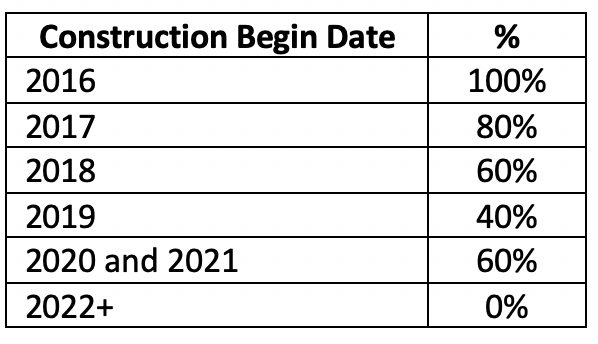

New mexico solar tax credit 2020 form Monday April 4 2022 Edit. New Mexico Taxation and Revenue Department Under penalty of perjury I declare that I have examined this claim and to the best of my knowledge and belief it is true correct and. Be installed on or after march 1 2020.

Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package. Solar Market Development Tax Credit SMTDC EMNRD is in the process of reviewing the provisions in the amendments made to the New Solar Market Development Tax Credit during. The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable.

For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. The 10 state solar tax credit is available for purchased home solar systems in new mexico. Form RPD-41317 Solar Market Development Tax Credit Claim Form is used by a taxpayer who has.

The solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2006.

Solar Tax Credit Explained Saveonenergy

How Much Do Solar Panels Cost 2022

To Expand Solar Energy New Mexico Government Renews Tax Credit

2022 New Mexico Solar Incentives Tax Credits Rebates More

Renewable Energy Tax Incentives Production And Investment Tax Credits Structure Diligence Considerations Alvarez Marsal Management Consulting Professional Services

Federal Solar Tax Credit Guide Atlantic Key Energy

Oil Companies Are Collapsing Due To Coronavirus But Wind And Solar Energy Keep Growing The New York Times

Solar Energy Bureau Of Land Management

New Mexico Solar Incentives New Mexico Solar Company

New Mexico Solar Incentives New Mexico Solar Company

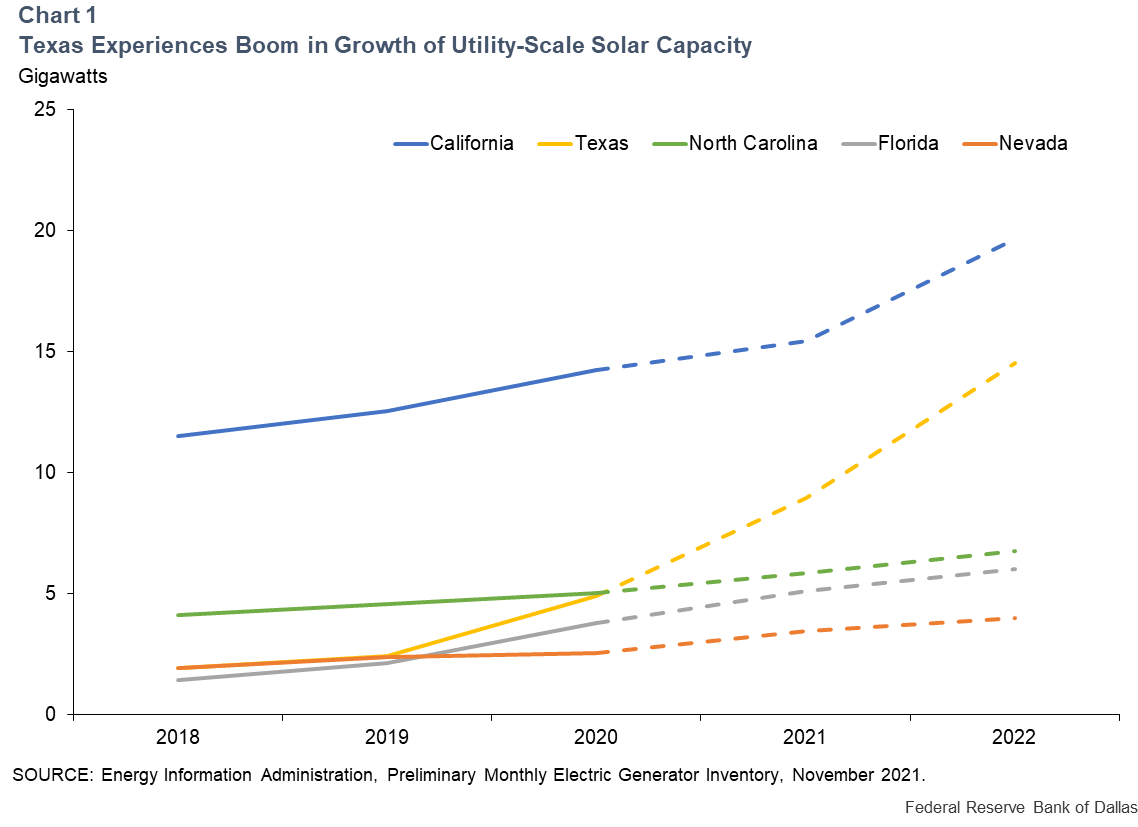

Solar Lights Up Outlook For Renewable Energy In Texas Dallasfed Org

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

A Guide To New Mexico S Tax System New Mexico Voices For Children

What Is The Federal Solar Investment Tax Credit Itc Bluesel Home Solar

Solar Tax Credit In 2021 Southface Solar Electric Az

2022 Massachusetts Solar Incentives Tax Credits

New Mexico Solar Tax Credit Affordable Solar

U S Energy Information Administration Eia Independent Statistics And Analysis